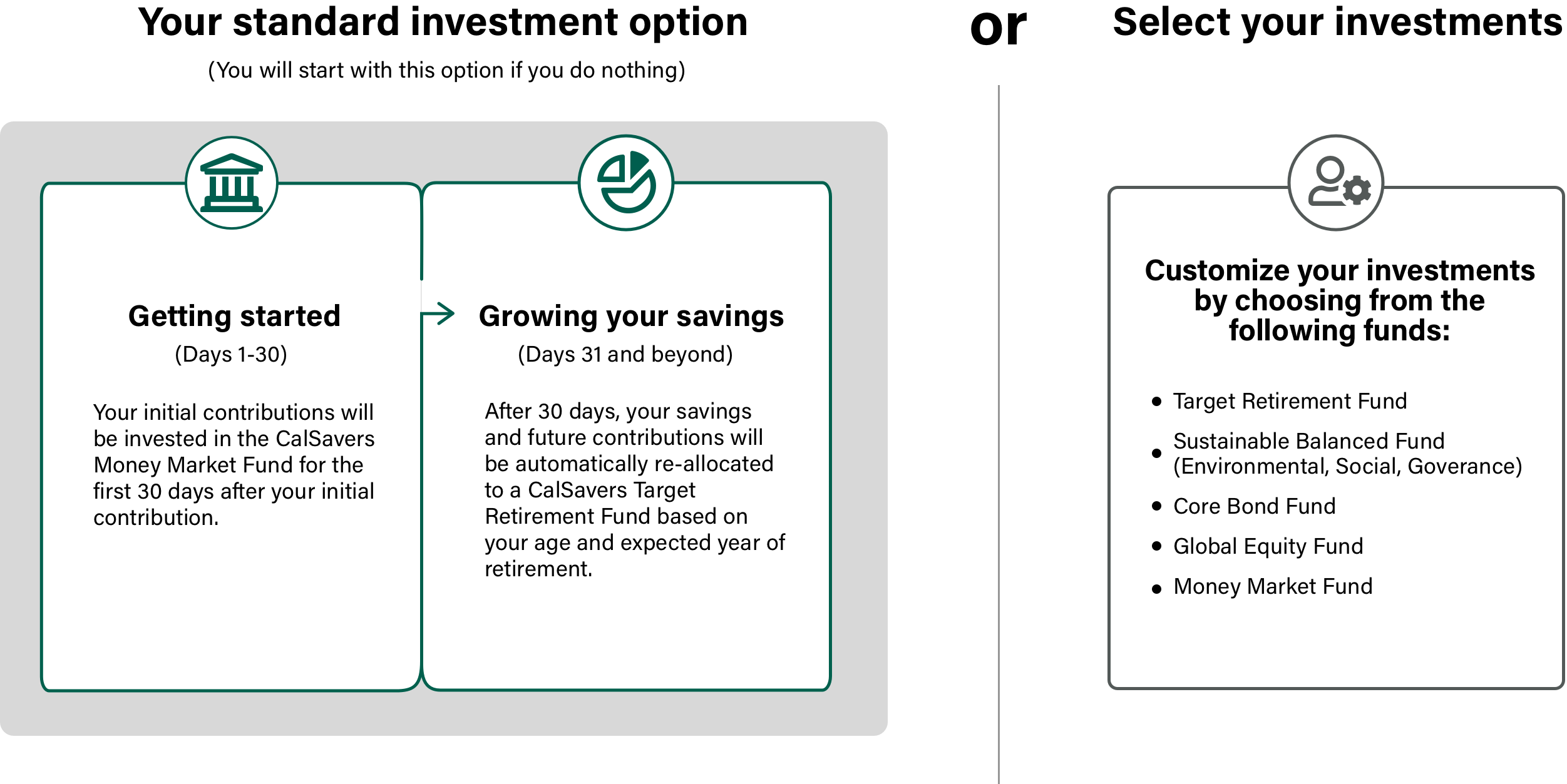

CalSavers offers a standard investment option so you can easily start saving for your future. Unless you select your investment(s), your initial contributions will be invested in the CalSavers Money Market Fund for thirty (30) days. After thirty (30) days from your first contribution, all subsequent contributions, along with any earnings in the Money Market Fund, will be re-allocated to a CalSavers Target Retirement Fund based on your age and the year closest to when a person your age is expected to retire.

CalSavers offers a range of different investment options to meet your needs no matter where you are in your retirement savings journey. An investment fund is a collection of different investments pooled together and are usually made up of stocks, bonds, and/or cash equivalents.

Investment funds are professionally managed and help to easily diversify your investments. You can find more information about the different investment funds that CalSavers offers below.

All investing is subject to risk, including the possible loss of the money you contribute through your payroll deductions. You should consult a tax or financial advisor if you have questions related to taxes or investments.